This post was originally published on this site

The Federal Trade Commission has challenged the validity of over 100 drug product patents, focusing on devices used to deliver medicines, like inhalers and autoinjectors, in an effort to increase competition and potentially lower some prices.

The FTC says drugmakers illegitimately use the patents to prevent competitors from offering cheaper generic alternatives.

It’s the first time the FTC has tried the tactic, said Hannah Garden-Monheit, director of the FTC’s Office of Policy Planning.

“We are using all the tools we have to bring down drug prices and reduce barriers to generic competition,” she said in an interview.

President Joe Biden has instructed his Federal Trade Commission to be more aggressive in reining in the pharmaceutical industry. Under its chairperson, Lina Khan, the agency is aggressively testing the limits of its powers in pursuit of that goal.

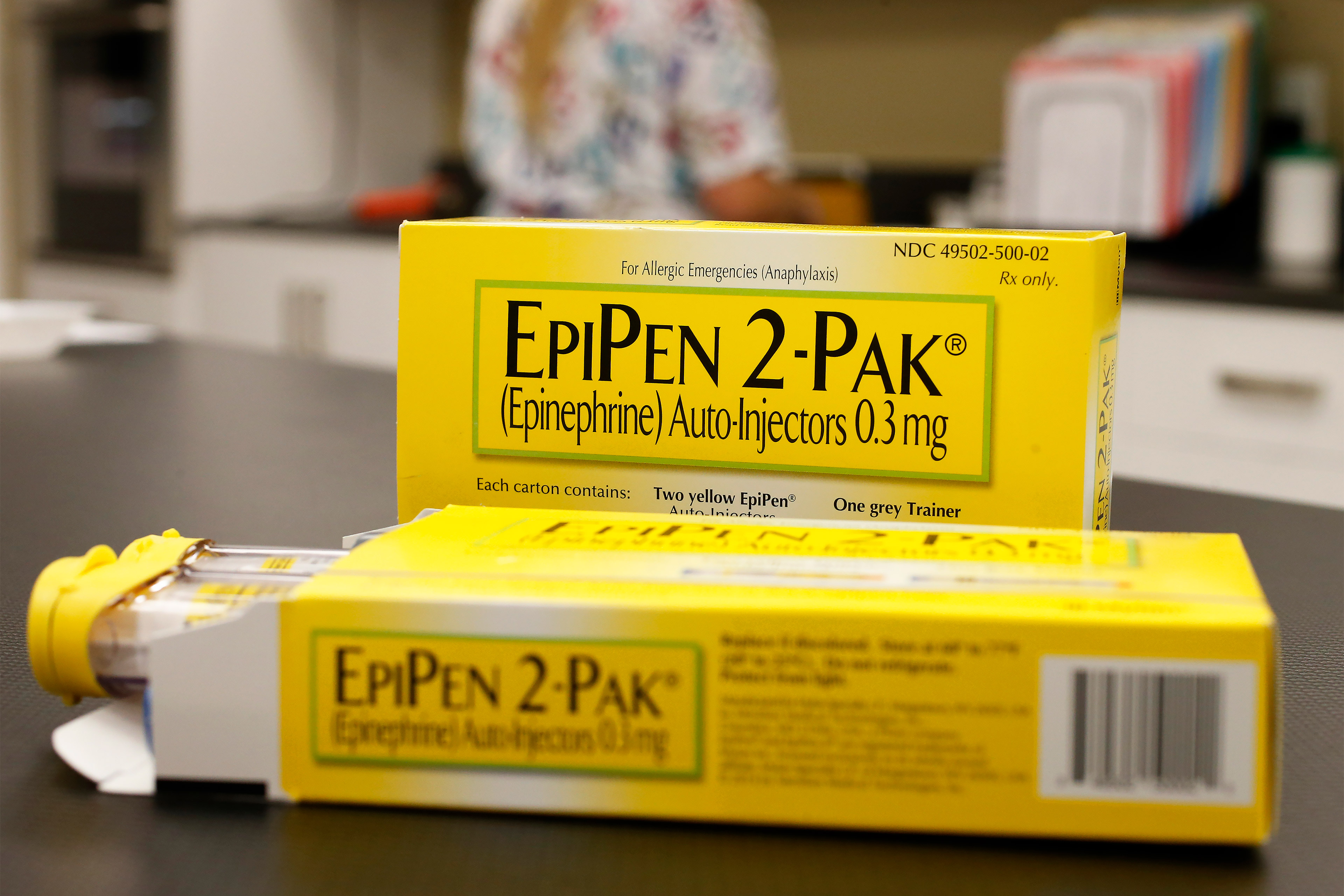

The targeted patents cover devices that propel medicines for asthma and emphysema into the lungs or inject epinephrine to treat a severe allergic attack. Drugmakers list them in the FDA’s “Orange Book,” which can afford the products greater protection from generic competition.

Many of the medicines delivered by the devices are decades old, years off patent. But manufacturers have long tweaked the delivery methods, patenting the changes, in ways that sometimes make the drugs more convenient to administer.

They might, for example, change the propellant in an inhaler or add a counter that tells a patient how many doses are left. Autoinjectors mean patients don’t see a needle or syringe but merely press a device with a hidden needle against the skin to deliver the medicine. Some autoinjectors even talk patients through the process.

Though there has long been a procedure for disputing the validity of Orange Book-listed patents, it is rarely used.

In challenging Orange Book listings, the FTC is trying to cut away at what are known as patent thickets. While a single patent once would cover a single active medicine, many drugs today are protected by half a dozen patents or more, creating additional obstacles for cheaper generics seeking to enter the market.

The move is critically important because drugmakers frequently extend the 20-year patent protection of a drug by changing the delivery device or method. For example, instead of a pill, they make a capsule. Or instead of a dose every six hours, they create a longer-acting, once-a-day version. They can also alter the process by which a drug is made — so-called “process patents.”

Each tweak gets a new patent, which the manufacturer then adds to its official compendium of drug patents. There is no advance scrutiny of listings by regulators.

Generic drugmakers wishing to make a copycat version of a branded drug generally have to challenge the patents in court. But merely listing a patent in the Orange Book automatically triggers a 2½-year delay of FDA approval of a litigating generic competitor.

The FTC says patent law protects active ingredients, not delivery methods.

The pharmaceutical industry, already battling the Biden administration’s plan to negotiate prices of some drugs for Medicare patients, says it wants more clarity about which aspects of its products can be patented.

“The underlying statute is not clear about listing certain types of drug delivery device patents, and the industry has long asked for the FDA to provide guidance,” said Megan Van Etten, a spokesperson for Pharmaceutical Research and Manufacturers of America, the industry trade group, in an email. “We’re disappointed that the FTC has characterized companies as acting inappropriately rather than help seek the clarity the industry needs to ensure compliance.”

After an FTC challenge, companies have 30 days to withdraw or amend the patent or show it is valid. Some have already backed down.

“We’ve had some significant wins,” Garden-Monheit said. After the FTC’s challenge, drugmaker GSK, formerly GlaxoSmithKline, withdrew all patents on two popular inhalers for asthma, Advair and Flovent, both of which contained old off-patent medicines but nonetheless cost hundreds of dollars. Amneal Pharmaceuticals withdrew patents on its epinephrine injector.

Still, the deadline for companies to respond to the first set of warning letters has passed and only about 30% of those that received them answered, leaving the commission to ponder its next steps. The FTC could take a drugmaker to court to seek a cease-and-desist order.

And Garden-Monheit said the agency is poised to look at other types of patents that may be invalid, which pile up to add to the thicket. There are thousands of patents in the Orange Book.

“We are taking a close and active look at this,” Garden-Monheit said. “Companies who haven’t received a letter from us challenging a patent shouldn’t think they’re off the hook.”

This article was produced by KFF Health News, formerly known as Kaiser Health News (KHN), a national newsroom that produces in-depth journalism about health issues and is one of the core operating programs at KFF — the independent source for health policy research, polling, and journalism.